Transcript

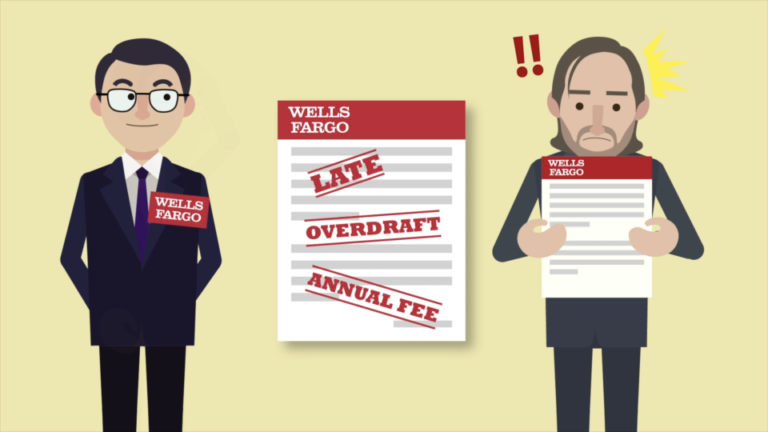

OK, so let’s get started with the first key ethics principle: trust. We already mentioned trust a lot in this chapter, and this is probably the simplest concept to understand. For example, it doesn’t take a finance or law degree to understand that the deceptive practices of Wells Fargo and its staff were incredibly unethical and likely criminal.

So we are not going to dwell too much on the concept of trust now. But it is worth repeating yet again that the entire financial system is built on trust, and therefore the bulk of criminal financial laws punish any breach of trust, or what we professionally call “fiduciary” obligations. As a side note, for those of you who are familiar with the term “fiduciary,” it may interest you to know that the Latin root of the word literally means “one who holds something in trust.”

Whether it was 250 years ago in a small European town where everyone knows each other, or in the much more complicated global marketplace that we have today, we have to understand that without a certain level of trust, the entire economic system comes crumbling down. Both traditional financial players and new FinTech innovators must keep this in mind, and ensure that their products and services continue to enhance trust.

In fact, because financial institutions play such an important role in society, and since most people are so clueless about complex financial products, most countries actually have disclosure requirements, meaning that banks have to be truthful and transparent with their customers, making sure they understand the nature of what they are buying or investing in.

If banks are not forthright about material information, they can have significant penalties, including fines and possibly jail time. In other words, financial institutions have a higher level of trust placed on them by society, so therefore they have higher penalties if they breach that trust.

As a result, one of the major considerations relating to FinTech revolves around the need to ensure that all FinTech applications and innovations enhance social and consumer trust, rather than diminish it. It would be unethical, for example, for unsafe or unclear financial products to be introduced into the market via a new FinTech app.

Unfortunately, some early iterations of FinTech have only caused the public to question the ethical use of these technologies. For example, the use of cryptocurrency to facilitate crimes has caused many people to be alarmed.

We need to address these concerns right from the beginning and ensure that tech innovators and finance professionals consider not only the bottom line but also the importance of maintaining balance and trust in society.