Transcript

One of the key principles we’ve been talking about is the idea that once new technologies are out, it’s very difficult to pull them back. There’s often this slippery slope kind of race to the bottom perspective. If you look at it from a corporate regulation standpoint, people who were seeking privacy would go off to these island nations, the Cayman Islands, the BBI, to create companies. Then they would outbid each other by trying to be more private and providing less information than others. While that attracted a lot of legitimate business, that also kind of increased the opportunity to abuse the system.

So, are we seeing this in the FinTech world as well?

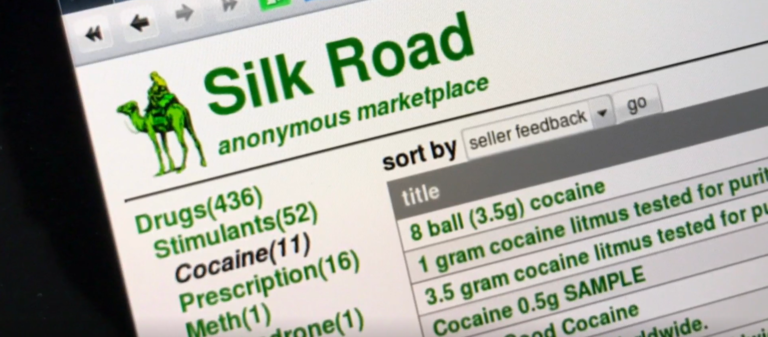

One of the drivers of allowing Silk Road to grow to the size that it was was the use of Bitcoin as the medium of transaction. We believe Bitcoin and these kinds of cryptocurrencies provide some level of anonymity. Though the block itself is exposed and people can see the transactions that are happening, the actual users themselves have some level of anonymity as opposed to you using your credit card and being able to immediately identify who you are.

And now we see the next iteration of Bitcoin is perhaps Monero, which is an alternative cryptocurrency that has developed quite rapidly in the last few years. One of its key characteristics is that it’s even more anonymous than other cryptocurrencies.

Again, there’s a potential slippery slope there.

One example of the usage of Monero is in North Korea. It was reported that the country is potentially mining Monero to circumvent transactions in the international financial system because they’re subject to a variety of UN sanctions and restrictions from accessing traditional financial markets at the moment. And, one way they could try to get around those is the use of a more secretive, less accessible form of cryptocurrency.

Back to the idea of the slippery slope, cryptocurrencies are seemingly in the race to become the most anonymous one.

But when you look at the moral underpinnings of why the founders of cryptocurrencies created them in the first place, it would be very much like Ulbrecht and Silk Road. They were based on moral principles, the idea to decentralise the marketplace. They wanted to democratise finance, and in many ways allow people to bypass governments and current forms of currency. So it’s interesting that very much like the Silk Road, what was initially perceived as a moral, at least partially a moral conviction is now being utilised in ways that perhaps weren’t initially anticipated.

There have been visionaries who had a really strong view about the role of cryptocurrencies, imagining a world where fiat currency is replaced by cryptocurrency. Because fiat currency is tied to governments and central banks, and that mechanism is increasingly archaic and inherently oppressive. Therefore, going to a more transparent and distributed system of cryptocurrencies was how they imagined the future would be.

Yet there is a great deal of irony here. Now not only do you have governments trying to regulate cryptocurrencies more, but they’re also getting involved in the use and production of it as well, potentially.