Transcript

Let’s talk about blockchain, which is one of the key catalysts for the rise of fintech.

Now a few upfront caveats: The focus of this chapter is NOT which cryptocurrency you should invest in and if you have followed cryptocurrency markets, it has been particularly volatile, so as the cryptocurrency enthusiasts like to say, “Hodl”—hold on for dear life.

Frankly, we don’t know which cryptocurrency you should invest your life savings in, so please don’t ask, if we did know, honestly, we probably wouldn’t be doing this book, we’d be at a warm beach.

So another caveat is that this chapter will also not discuss initial coin offerings- ICOs, IICOs, STOs, or any of the variants by which someone might try to fundraise or monetize for their blockchain project. Don’t get us wrong, these mechanisms are all interesting, but there is so much information to cover, it could easily be its book, and because of changing laws and regulations in different jurisdictions, it’s difficult to explain in a snapshot format since the regulatory landscape is constantly changing.

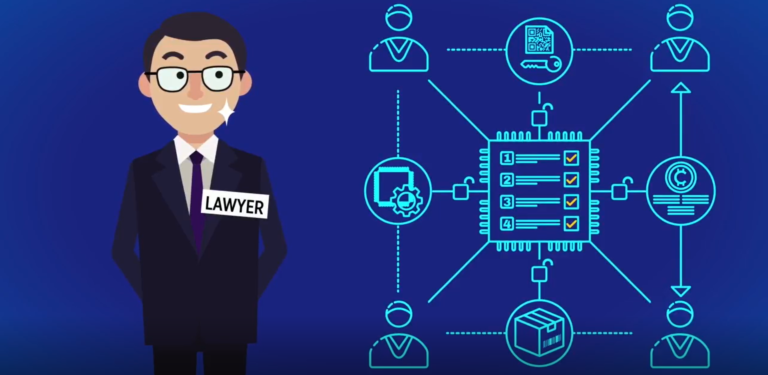

Maybe most importantly, though we are both lawyers, we’re not your lawyers, so if this is something you are thinking about doing as part of a blockchain project, please speak with your lawyer.

Now given what we just said, the focus of our chapter is more about questions that might be good to consider as blockchain technologies become more pervasive. Really what are blockchain’s implications–both the wonderful disruptive possibilities that it represents as well as potential issues we should consider before completely embracing it.