Transcript

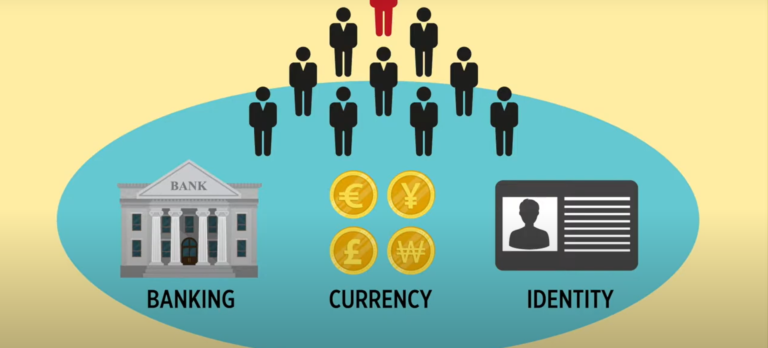

In this module we are going to talk about some of the key reasons that people are calling for FinTech innovation, and one of those main things is the decentralised status, the nature of this, thus democratising finance and allowing regular people to participate more fully and affordably in financial transactions through technologies like cryptocurrency, non-government-issued IDs, peer-to-peer lending, things of that nature. And we’re going to address some really big questions, considering whether FinTech should lead to a decentralised, democratised system of finance, or whether existing institutions will adopt FinTech strategies to cement their existing hold on financial markets. We’re going to discuss these major themes, including the perceived desire for democratisation of goods and services. Is that good or bad? Will there be unintended consequences? So a lot of this is going to be a continuation of things that we’ve talked about in other modules, including module two where we talked about blockchain. So we’ll be referencing back to those from time to time. And one of the key things that we’re going to be emphasising is the sources of power. So, for example, will FinTech innovation lead to a decentralisation of power, or maybe a concentration of existing power sources like governments and banks? Or will a new concentration of power really be created in TechFins like Amazon or Tencent, which owns an app like WeChat, for example?

We’re going to start module five with a quick story. David Bishop has been living and working in China for over a decade. In 2018, he had the opportunity to go to a small part of Western China that he’d never been to before. It was a rural city with a desert landscape and dust everywhere. In the morning he decided not to eat breakfast in the hotel but explored on the street. He noticed a particular street vendor, an old woman, who clearly has done this for a very long time and she was surrounded by people. It was obvious that her food was quite popular. So, he went over there quite excitedly, watched what everybody was doing. When it came to be his turn he ordered some food with his somewhat fluent Chinese.

As he reached into his wallet and started to pull out some cash, he could immediately see the concern on the face of the vendor. They both had the realisation that every other single person in that circle had paid using their phone and she did not have the ability to give him change with cash. So there he was, probably the person who had most access to the financial industry, and yet I was the one that was completely cut out of the transaction and even this marketplace.

Even though David was upset that he could not have his breakfast, he found the experience super cook because this community in rural Western China had in a short amount of time moved almost completely away from cash. And for you readers who have been living through this change, we believe you would agree with him.

So, we think this story is a good summary not only for the things that we’ve discussed in previous chapters but also a nice transition to help us start asking some of the bigger questions.

Before you move on to the next section, think about David Bishop’s experience. From a FinTech standpoint, what are some of the observations that you have, especially about how FinTech is impacting people in different communities all over the world.