Transcript

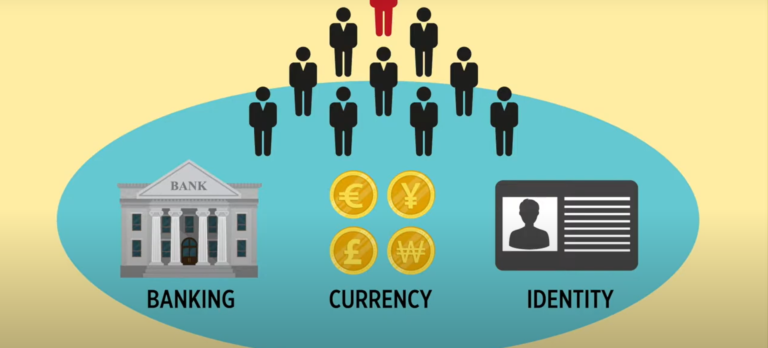

OK, so far in this chapter we’ve talked about power and control, in particular control over banking, currency, and our identities. We’ve also outlined how scandals and problems have caused governments and traditional financial institutions to lose consumer trust, further pushing FinTech innovation.

And we know that FinTech innovators are pushing for a democratisation of finance, which largely centres on bringing financial products to the poor and disadvantaged. Through disaggregation, people are getting more information about financial products such as life insurance and mortgages so that they’re making more informed and efficient decisions to the increased opportunities that they now have.

And through disintermediation and decentralisation, FinTech is both cutting out the middleman who normally controls financial transactions and giving control to multiple players simultaneously, respectively.

Finally, by de-biasing finance, finance is hopefully removing traditional biases like race or gender from the process and making finance easier to understand and access.

The aggregation of these five principles is commonly summarised by one word: inclusion. The drive towards greater financial inclusion is one of the key elements that makes FinTech so compelling and is making a system-wide impact possible. For example, there are currently approximately 1.7 billion people in the world who are unbanked. Well, the World Bank has a goal to ensure they all have access to banking by 2020. And while that may still seem like a crazy, audacious goal, because of finance innovations it’s possible.

According to the World Bank, “Financial inclusion means that,” quote, “individuals and businesses have access “to useful and affordable financial products and services “that meet their needs, “transactions, payments, savings, credit, and insurance, “delivered in a responsible and sustainable way.”

Overall, FinTech has the potential to benefit underserved communities and individuals through a large array of features, like cross-border remittances, payment technologies using digital know-your-customer processes, alternative credit scoring, e-wallets, mobile money, microfinance, crowdfunding, and more. And the Global Findex database by the World Bank has shown how the share of adults holding a bank account has risen from 51% in 2011 to 69% in 2017. That’s amazing and exciting when you consider that having access to banking is one of the key factors for raising people out of poverty.

And access to finance increasingly means access to the Internet and all things digital. This is perhaps most evident in China, where 890 million people are now using mobile phone payment apps and the transition to a cashless society has happened rapidly. These apps have a whole array of services that you can access with a few clicks on your phone. But the switch to a digital economy can also exacerbate exclusion. For example, in China it has widely been reported that the elderly are struggling to keep up with rapid technological advancements. As a result, what is supposed to make life easier for these citizens in some ways has done the opposite, particularly the 118 million elderly who live alone.

Discussion Questions

- Is it better to have an efficient financial system where everything moves online, everything’s digital, and it makes things more efficient, more smooth, and cheaper, or are we concerned enough about the elderly or the poor or those that are disadvantaged not having access to a system?

- For example, should a store be forced to receive and accept cash payments, or can we go completely cashless in society?