Transcript

To answer our question: as we’ve discussed throughout this course, finance is critical for the proper functioning of society. Places where people are free, where they’re educated, where basically you’d want to live and travel to are places that have a highly functioning financial system. So it’s imperative for us to realise that it’s critical to do it right and do it well, and to see this not just as a money-making exercise, but to actually insert some social purposes.

It’s important to remember the history of banks: it’s about trust, safety, and stability of society. But have we gone so far with technology like algorithmic trading that we have forgotten what finance was about initially?

To be honest, algorithmic trading as it is today is only the tip of the iceberg in terms of where technology interfaces with traditional financial services. Structural changes are already starting to happen as different technologies are entering financial markets where banks and other financial institutions traditionally operate. It is an ongoing process that will continue and compound with speed over time as these new technologies permeate different functions of banks.

Such integration will continue to have a profound impact on our society in multiple ways. On the one hand, the current financial industry as a whole is a large employer of a lot of people globally. But the reality is that many of these people are going to be displaced as technology penetrates deeper and deeper into the industry. If you look at the distribution of employment at large investment banks and other financial institutions, increasingly, the percentage of people in technology is much higher than it was 20 years ago. That trend will continue which is indicative of few and few pure finance roles, but more and more hybrid roles – like David Bishop’s friend.

But to the broader foundational point, we are asking banks and other financial institutions to play a bigger role than just making money. Finance fuels the development of many aspects of our society and social mobility of both individuals, people like you and me to buy a home or get a bank loan, and countries such as Kenya or Myanmar, who rely on large financial institutions at the macro-level to move from a developing country closer to a developed nation.

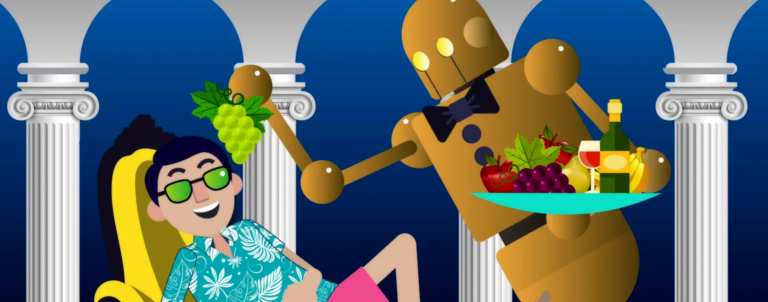

If you think of law as the infrastructure for society, finance is the fuel. In the idea of a Utopian society, there’s the structural part of it, being the government and laws, but ultimately a big part of it is going to be the people. Therefore we hope that founders of new companies, leaders of various organisations, and consumers like yourself, would listen to this call of trying to be more purpose-driven in addition to pursuing a profitable business. Such a combination will help us get to a place closer to an ideal world, this utopia we’ve been talking about.

Going back to the very beginning of this book, where we discussed the concept of cultural lag. Different types of culture change at different speeds, and technology in particular is changing incredibly quickly other aspects of society such as law and religion are not going to be changing nearly as quickly. What that means is, again, we’re not going to be able to rely solely on legislation and government in order to regulate and police these innovations. That’s why it’s so much more important for us to think about the moral implications of these technologies and for us to rely on other stakeholders including the consumers, you and I, and the innovators that are actually bringing these changes to the marketplace.

So for the remainder of this chapter, we’re going to focus primarily on these innovators, people who are choosing right at the outset to build business models that not only generate profit and sustainability but will also do some type of social benefit within the context of their service and product.