Transcript

Now, in this module, we’ve primarily considered the disruptive nature of FinTech at the individual and national levels. But we wanted to end it with a quick discussion about the implications at the global level.

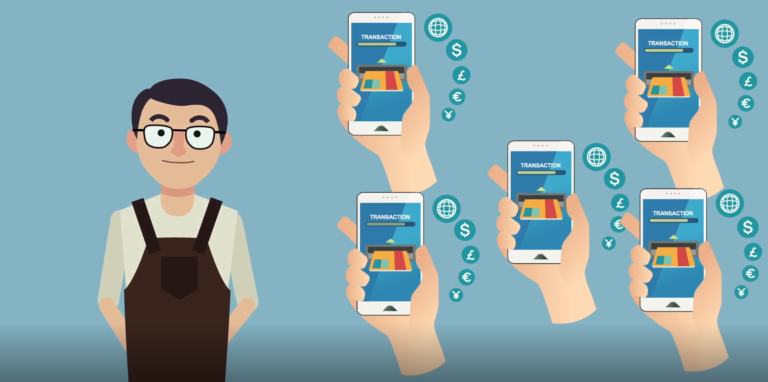

So, let’s revisit again the example of David Bishop visiting the street vendor in China to try to find his breakfast, this time from a more technical standpoint. The peer-to-peer payment system utilised by the vendor and the customers that day was significantly more advanced than what is typically utilised somewhere like in Hong Kong, even though Hong Kong is generally considered a global financial centre. If you think about it from a FinTech standpoint, China and other developing nations have in many ways been able to leapfrog the legacy infrastructure seen in developed countries.

This is partly due to the fact that developing countries do not have as large of a financial and cultural stake in traditional finance infrastructure, so they’ve been able to move past the developed world in some ways. For someone who has never used a peer-to-peer mobile finance application, for example, doing so may seem insecure and scary. But for someone who has only known banking on their smartphones, writing and sending a cheque may seem not only archaic and slow but even more insecure than using the peer-to-peer transfer system.

Many developing countries that are now working to improve their financial infrastructure will completely leapfrog much of the physical infrastructure that defines the finance industry in most of the developed world. For example, many customers in Africa and Asia will maybe never use an ATM nor will they ever step foot inside a physical brick-and-mortar bank.

Now, as a personal example, over the 12 years that I’ve lived in Hong Kong, many businesses in the US have been reluctant to receive wire transfers from my overseas bank, preferring instead for me to send a cheque to them. Now, I protest, explaining that doing so would be extremely slow, very expensive, and more susceptible to fraud or theft. But because this is their legacy payment system, they stick with what they know and trust.

As a result, some of the most advanced economies in the world are actually the slowest to adopt FinTech innovations, lagging behind many countries in Asia and Africa in regards to FinTech.

In the context of identity, for example, countries such as Kenya, Bangladesh, and Guinea, who though lacked these legacy identity systems, are building digital identification systems, and many other government services are going from basically non-existent straight to digital payment or record systems. For example, David Bishop visited Myanmar in early 2017 and he was incredibly impressed by a startup there called KoeKoeTech. As many of you know, the country of Myanmar was only opened to the outside world in 2012. And as a result, they have an enthusiastic but underdeveloped government sector that in many ways lags behind the rest of the world. But KoeKoeTech and other companies like it are helping to digitise the Myanmar government systems. As a result, they may end up with a more advanced digital government payment and record-keeping system than advanced countries like the US which are now burdened by ageing technical infrastructure.

It’s important to remember that while much of the world is talking about the Fourth Industrial Revolution, some of the world is still struggling with implementation of technologies that came about around the time of the First Industrial Revolution. Using Myanmar again as an example, seven years ago Myanmar had a nearly non-existent formal banking sector, but in just six years they’ve obtained 80% smartphone penetration and have seen millions get access to mobile financial services. This is quite remarkable if you consider that over 30% of Myanmar’s population lives below the national poverty line as of 2015. And hopefully with further advancements in FinTech, the amount of poverty will continue to shrink and access to financial services will continue to climb.

Similarly, in 2016, 33 million Kenyans owned mobile phones but 26.7 million had registered mobile transfer service accounts. It’s amazing. This was made possible because traditional banking systems were not accessible to low-wage earners and banks were not accessible in remote areas. So throughout Kenya they’re cutting out ATMs, reducing them by about 30% so far and only leaving around 2,000 ATMs in the entire country. This is a place where, according to UNICEF, access to basic quality services such as health care, education, clean water, and sanitation are often a luxury for some people. Now, their access to mobile banking though is really remarkable and a great sign of things to come.

Discussion Questions

- Do you think that developing countries have an advantage of some sorts from a financial infrastructure standpoint?