Transcript

As many of you know, Hong Kong is dynamic, global, and one of the most interesting cities in the world. A part of Hong Kong’s story that most casual observers are not aware of is that embedded within Hong Kong’s cosmopolitan makeup are hundreds of thousands of women that provide childcare, home care, and other household duties for many of Hong Kong’s families. These women are designated as Foreign Domestic Workers, but are usually referred to as “helpers”, “a-yi”, or “Aunty”.

There are approximately 400,000 of these women working in Hong Kong, most hailing from the Philippines or Indonesia. These women are generally paid around US$570 a month or roughly US$ 7,000 a year, most of which is remitted back to their home countries to support their families.

The reality is that most of these women work really hard for a salary that you and I may not consider that high, but that salary is almost double the GDP per capita in the Philippines. In the aggregate, these remittances by overseas workers, according to World Bank data, account for approximately 10% of the Philippines’ GDP. So individually and at a national level, the money really adds up and the impact of these wages is a very big deal.

Now how does this money in Hong Kong make its way to a family living in a village somewhere in the Philippines? Well, besides being one of the course instructors, we are fortunate that David Bishop is one of the world’s foremost experts on issues related to domestic helpers and how to protect them from exploitation. So, let’s hear it from him about the issues these women face when sending money back home.

So, you might think that if you were going to send money, maybe you have a bank account and you would just do a bank transfer. Simple, problem solved. Unfortunately, for the tens of millions of migrant workers around the world, this is usually not possible, since they are generally unbanked on both sides.

Meaning, the foreign domestic workers in Hong Kong, many of them don’t have a bank account here in Hong Kong and their families on the other side, people they are sending money to, typically don’t have a bank account either. So the workers receive their wages in cash and they have to figure out how to get that cash from Hong Kong to their family in a remote village somewhere perhaps in the Philippines.

To fill such needs, money remittance companies have sprung up all over the world, the most famous probably being Western Union. And for decades this is how people transferred money. As part of this process, there are two important things to note, which might not be apparent. First, there is a physical component when remitting money. A worker has to physically go to one of these locations to actually hand them cash. Then on the other side, there is another physical location, where the receiver has to go to pick up the money. So both sending and receiving is a very time and labour-intensive process, due to standing in lines, walking long distances, and perhaps waiting for and using public transportation, which comparatively might not be cheap. In addition, many of these workers only have one day off a week, usually Sunday, so much of that day could be wasted trying to send money home.

Second, is an issue of financial literacy.These money remittance companies charge fees that you and I may consider excessive, sometimes as high as 8 or 9% per transfer. Additionally, currency conversion fees are typically not competitive. So, even if a remittance company has a low rate for sending money, they will likely make money on the currency conversion, like when converting from, say HKD to Philippines pesos. On top of all that, sometimes remittances can take time, at least a few days if not longer.

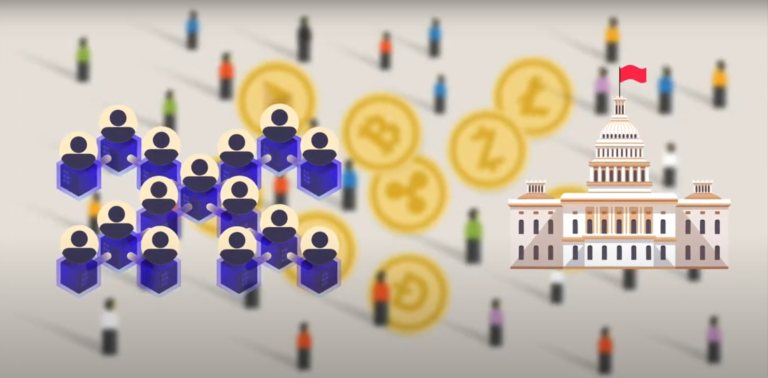

I’m not saying these companies shouldn’t make money for providing a service, but frequently their customers are not really that informed or have limited options. So a natural question is: what if that lost friction or time, or unnecessary fees can be avoided or at least reduced? For many, the answer to that question, or at least an important component to that question, is the use of blockchain technology.

Today there are a number of remittance services that are trying to employ some level of blockchain to minimize many of the frictions that we have discussed, by promising to make remittances more efficient, secure and/or affordable. As these innovators pressure incumbents, there will be a shift, first a trickle but then a wave, as users become comfortable adopting new technology, bridging any cultural lag and learning to trust new advances in technology.

Discussion Questions

- What ethical issues are involved in the case of Hong Kong domestic helpers using foreign remittances services?

- In what ways could a blockchain-based remittance system benefit the developing world?

Additional Readings

- Massimo, F. (2018). How Blockchain-Based Technology Is Disrupting Migrants’ Remittances: A Preliminary Assessment. Publications Office of the European Union. Retrieved from http://publications.jrc.ec.europa.eu/repository/bitstream/JRC113484/how_blockchain_is_disrupting_migrants_remittances_online.pdf

- A Migrant Centered Approach to Remittances. (2017). International Labour Organization. Retrieved from http://www.ilo.org/global/topics/labour-migration/policy-areas/remittances/lang–en/index.htm

- Record High Remittances Sent Globally in 2018. (2019). World Bank. Retrieved from https://www.worldbank.org/en/news/press-release/2019/04/08/record-high-remittances-sent-globally-in-2018